The psychological challenge of trading real money consistently trips up many binary options traders. As one experienced trader puts it, “The biggest hurdle most traders never overcome is themselves – human emotion combined with an incomplete trading plan usually leads to financial ruin.“

Developing Rules and Controlling Emotions

Trading binary options profitably over the long-term requires discipline, risk management, and a solid strategy. Many traders struggle with the emotional aspect of putting real money on the line. This can lead to impulsive decision-making like entering trades too early, choosing sub-optimal market conditions, or overtrading.

To overcome these psychological hurdles, it’s crucial to implement rules that regulate your trading behavior. As Michael Martin writes in his book The Disciplined Trader, “Humans have a natural tendency to deviate from any plans or rules they make for themselves. That’s why it is essential to follow preset rules and align your body and emotions to stick to your plan.“

One effective approach is to cap the maximum number of trades per day:

- Set a fixed limit like 3 trades maximum

- Or a combined limit of winners and losers (e.g. stop after 3 losses or 5 wins)

You can change the numbers to match your trading strategy, expiration times etc. the important aspect is setting a fixed end for the trading session! Time based won’t work as it entices traders to trade more in shorter time, exactly what we do not want!

This forces you to be selective about the trading opportunities you pursue rather than overtrade on marginally favorable setups.

Using Optimal Trade Setups

Another key is picking trades with realistic profit potential by utilizing longer expiry times and higher timeframes for analysis. Strategies that simply bet on the direction of the next single candlestick are extremely high risk. It’s better to give trades time to develop by using:

- Hourly or greater timeframes for entry signals

- Allowing daily or greater expiries

As the old trading adage goes, “The trend is your friend.” Timing entries is critical to align with the overarching trend and momentum based on technical analysis of multiple timeframes.

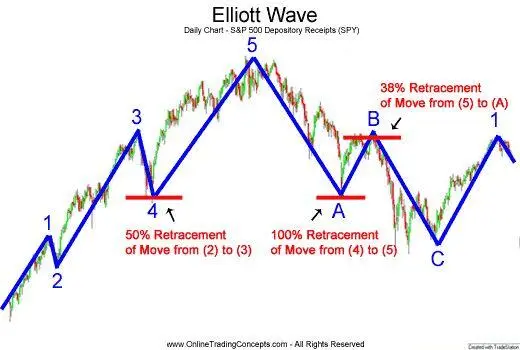

For example, if you identify an impulsive wave pattern traveling upwards on the daily chart, you can look to buy retracements against that dominant trend on a lower timeframe like the 4-hour or 1-hour chart using tools like:

- Elliot Wave theory to identify retracement levels

- Trendlines and support/resistance levels

- Indicators measuring volatility or momentum

Risk Management

Even with sound trade criteria, no strategy wins 100% of the time. As trading legend Bruce Kovner says, “The philosophy of crisis management is that individual mistakes get made, so don’t dwell on them.“

Implementing risk management rules like a maximum acceptable loss per day or week can prevent a single bad day from depleting your entire account balance. Preserving capital allows you to remain in the game long enough for the statistical probabilities to play out in your favor.

A good rule of tumb is to never invest more than 5% of your overall capital into your trading positions, if possible choose 0.5 – 1%, while you won´t get rich over night with this money management (You won´t with another either), it makes it almost impossible to crash your account in a single day or week as you need to lose 100 trades without a single win!

Be careful with martingale money management, while this can massively increase your winnings by winning back the lost amount of money with the next trade, but it carries a EXTREME Risk if its done wrong! Never ever use this method to trade a strategy not working with fixed money management, if you can’t be profitable with a strategy without martingale, the strategy is simply not good (or not the right strategy for you, or you still need to figure out when to trade the strategy for best results).

If you decide to trade with martingale, ensure to apply the 5% rule, if your investment for a single position nears 5%, stop trading even if you lost the entire row of trades!

The Path to Consistent Profits

The path to consistent binary options profits isn’t easy, but managing risk through predefined rules, timing entries with trends, using realistic expires, and capping daily losses can vastly improve your chances of success over amateur traders. As trading pioneer Jesse Livermore remarked, “It wasn’t easy, but if you have patience operating laws that control human nature, there is money to be made in speculating.”

Patience, discipline and controlling emotions are vital. Follow your rules, wait for high-quality trade setups aligned with the bigger picture, and exercise proper risk management. That’s the winning recipe for binary options trading.