When you want to trade binary options for constant returns, you need to know exactly what are you doing! Beside your Money Management and your binary options trading strategy, it is important to know when to trade, and when to avoid trading a specific market!

Inside this blog post and Video, I will show you how to preselect the best market for your strategy in order to increase your winning rate as well as overall profit! Keep in mind that binary options trading starts with a proper trading strategy as well as a good money management, if you get one of both points wrong, you will lose your money!

As you can see inside the video, it is possible to avoid bad markets and detect markets with a good chance that your strategy will work properly!

Let’s take a closer look at markets I would avoid to trade for the most strategies, in fact, it always depends on the strategy! A News Trading strategy for example would wait to trade news and would avoid trading other markets, and a breakout strategy would look at markets with low movements, expecting a breakout in the near future!

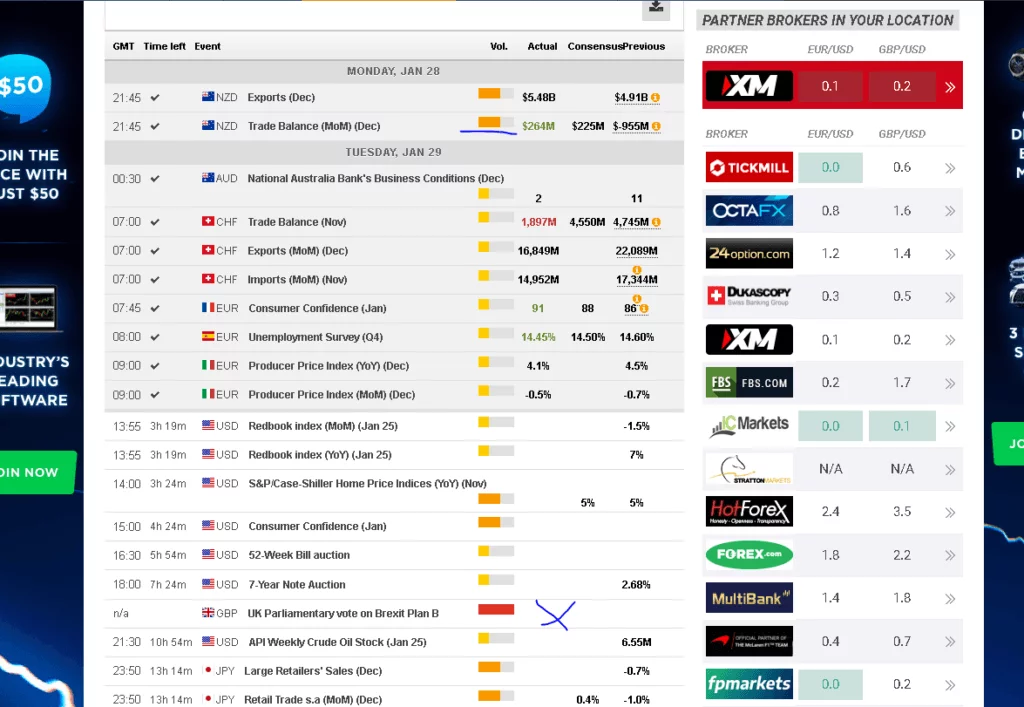

Avoid News – Make sure to check the economic calendar at FX street regularly before you start trading. Avoid Assets with high impact news in the near future (The next hour)

Markets with No or Low Momentum / Movement – Do not trade normal binary options when there is no market movement! If you want to trade when markets are not moving, ensure to trade Ladder Options, click here to learn more! Another option for this market are short term binary options below 2 minutes expiration time!

Chaotic looking markets – If there are many candles with long wicks and, I recommend avoiding trading! Below is a picture gallery showing some examples for “bad” markets!

Ok, let’s take a look at a few examples of good-looking markets to trade!

Try to detect the Elliot Wave Principle inside the chart, take a look at the picture below for more information about Elliot Wave :

Elliot Wave Theory is a popular technical analysis approach used in financial markets, and perfectly usable for binary options trading. It suggests that price movements exhibit repetitive patterns based on investor psychology. Here’s a simplified explanation with a short example below:

I highly recommend learning the basics of the Elliott wave theory to increase your win ratio by up to 10% … Click Here!

Let’s consider a binary options trading scenario based on Elliot Wave Theory:

Remember that successful binary options trading involves a comprehensive understanding of various factors, and Elliot Wave Theory is just one tool in a trader’s toolbox. Always combine it with proper risk management and additional analysis techniques to improve your trading decisions.

Disclaimer: Trading involves risk, and binary options are speculative instruments. It is important to learn and practice before engaging in real money trading.

Click here to get more than 70 Videos teaching you everything about Forex & binary options trading, Chart Formations and Candlestick Charts!

PhoenixApp.io Review Introduction If you're on the lookout for a comprehensive review of PhoenixApp.io, a dynamic platform that promises to…

Unveiling Trading Titans: Deciphering Quotex and World Forex Navigating the complexities of the trading world, understanding the powerhouses in this…

Empowering Traders in the Digital Age IQcent: Revolutionizing Trading for the Modern Trader In today's rapidly evolving financial landscape, traders…

Unveiling the Potential of Binarycent: A Trader's Guide to Success Binarycent Review: A Comprehensive Guide to Unveiling Trading Opportunities In…

Unveiling Raceoption: A Comprehensive Guide to Binary Options Trading Raceoption is a leading binary options broker that offers a user-friendly…

Unlock the Power of Binary Options Trading: A Guide to Choosing the Best Platform for Success in 2024 Binary options…

This website uses cookies.