Welcome to the 2. BOSbS video about How to Learn binary Options Trading Step by Step! Inside you learn the candlestick chart basics as well as how to use my price action trading strategy for binary options! Make sure to watch all videos inside this series before you start trading with real money!

Create your free demo account and start trading without risk … Click Here!

What you will learn inside the 2. BOSbS Video:

- How to use and read charts!

- Binary Options Strategies explained

- My Price Action Strategy explained

- Price Action Strategy examples

- Money Management

Trading Strategy: A binary options strategy is a set of rules you use to determine when to enter a trade, in which direction and expiration time!

Money Management: The money management is a set of rules to define which amount to invest into a single position. Both parts are essential to succeed with binary options trading or Forex trading.

Risk Disclaimer: Your capital might be at risk! Binary options and Forex trading carries a certain level of risk!

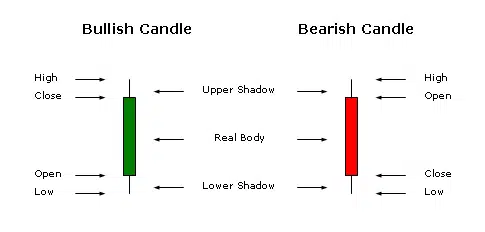

Candlestick Chart Basics

Take a closer look at this picture to learn how to read candlestick charts! The advanced charts provide more information as the widely used line chart, as every candle shows 4 factors! We will go deeper into the Candlestick Chart Basics in the next video!

Price Action Strategy Explained

My price action strategy contains two parts, the „price action“ part and the indicator based verification part. Price Action is a technique to predict market moves using the previous market behavior, often used tools are Trend Lines, Support and Resistance, Fibonacci Retracement and candlestick formations (Will explain them all, but step by step).

Price action is a bit difficult for many new trader, but its not too hard if you concentrate on some basic methods first.

Depending on the market situation, you can use different methods for my strategy, in this video, I will show you the usage of Support and Resistance lines, next video i will show you trend lines and Fibonacci!

The second part is indicator based using the Stochastic oscillator, i suggest to read the explanation inside the Pocket Option trading panel, or google for „Stochastic Oscillator“ for a detailed explanation!

Important: Keep in mind that a specific strategy is made for specific situations.

Most strategies won´t work in other market situations. So the trick is, to learn to detect the good markets, and avoid the bad markets (For the specific strategy).

My Strategy can be used in many situations, but you need to use the matching price action tool to succeed! I recommend to concentrate on strong, but consistent trends, and to avoid „chaotic“ trends as well as side-way markets!

I also suggest to learn more about the different indicators, and the other tools step by step, so you can use them whenever you need more information to make a proper trading decision!

Lets Take a look into my Strategy PDF first, then we take a look into the markets and search for a good looking market to trade an example position!

Indicator I Use for my Trading Strategy

Simple Moving Average – Period 34 (can be used as dynamic trend line)

Stochastic – 5 / 3 / 3 (Works as verification – best in combination with candlestick formations)

Depending on the market situation, add Trend Lines or Support Resistance / Fibonacci Retracements to the chart! (More about these tools in the next video or inside my Youtube channel – Take also a look into the video description to find more information about Price Action)

Money Management

The Money Management defines how much to invest into a single position, there are different methods used here, mainly the „fixed money management“ and the „variable Money Management“ system.

The fixed MM : Here you define the position size once, and you trade only this investment amount in every trade! For example: You define that you trade 1% of your capital per position, and you got a balance of 500 Usd, you would trade a max. of 5 Usd per position!

Variable MM: Here you change the amount depending on the situation! This should only be used by experienced traders. One popular method is the Martingale Strategy, where you always increase your investment after you loss a position, hoping to win back the previous loss and to make a small profit on top of it! THIS IS RISKY – After 4 – 7 miss trades in a row you normally are out of money!

Important rule: Never ever invest more than 5% of your overall capital into a single position, best would be between 0.5 – 2% or even less!

Make sure to practice what you learned so far, and feel free to play around with different indicators and tools you find inside the trading platform!

If you liked the video, please Like and Share it using the buttons here on the page! Also feel free to ask your questions below as comment, I will answer as soon as possible! If you havn´t already, make sure to get my Price Action Strategy for Binary Options as PDF .. Click Here!