How AI Can Spot Trading Patterns Like a Pro

Can artificial intelligence really outsmart seasoned traders at their own game? I put Google AI Studio to the test, and the results might shock you: it spotted a breakout pattern on Tesla’s chart that I nearly missed—and calculated a $647 profit on SPY in seconds! Whether you’re a day trading guru or just dipping your toes into stocks and crypto, this article promises to reveal how AI can supercharge your chart analysis. Curious if a machine can beat your trading instincts? Stick around as I unpack a real-time experiment that’s changing the way we look at patterns, trends, and profits—all without needing a finance degree. Ready to see AI in action? Let’s dive in!

Introduction

Hey there, trading enthusiasts! If you’ve ever wondered how artificial intelligence is shaking up the stock and crypto markets, you’re in for a treat. I recently stumbled across a mind-blowing video where a trader tests Google AI Studio’s real-time streaming feature—a tool that watches your screen and talks you through chart analysis like a virtual trading buddy. The goal? To see if AI can spot patterns and setups that could lead to winning trades. Spoiler alert: it’s pretty darn impressive, but it’s not flawless. In this article, we’re breaking down what I learned from this experiment and how you can use AI to level up your trading game.

The video kicks off with a bold idea: since AI already powers a ton of market trades, why not let it analyze our charts? The host fires up Google AI Studio, shares their screen, and dives into Tesla’s 240-minute chart. The AI quickly identifies an ascending triangle—a classic breakout signal—and even suggests a trade entry at $440. Then, it tackles SPY, spotting a reversal after a big red candle and calculating a shorting profit in real time. It’s not just about the wins, though; the AI stumbled when pushed too far, crashing mid-analysis on a broader portfolio. Still, the potential is undeniable.

So, what’s in it for you? Whether you’re trading Tesla stock, SPY ETFs, or even crypto, this article will walk you through how AI can spot patterns like a pro. We’ll cover what Google AI Studio is, how it nailed Tesla’s breakout setup, why it flagged SPY’s reversal, and—most importantly—how you can pair AI with your own strategy for maximum impact. I’ll throw in actionable tips, straight from the transcript, to help you test this tech yourself. By the end, you’ll know if AI is your next trading superpower or just a flashy sidekick. Let’s get started!

Oh, and a quick heads-up: this isn’t financial advice (I’m no Wall Street wizard, and neither is the AI). It’s all about exploring what’s possible with tools like Google AI Studio, which blends real-time screen analysis with a conversational twist. Whether you use TradeStation or another platform, the insights here are universal. Ready to see how AI stacks up against human intuition? Let’s roll!

What Is Google AI Studio?

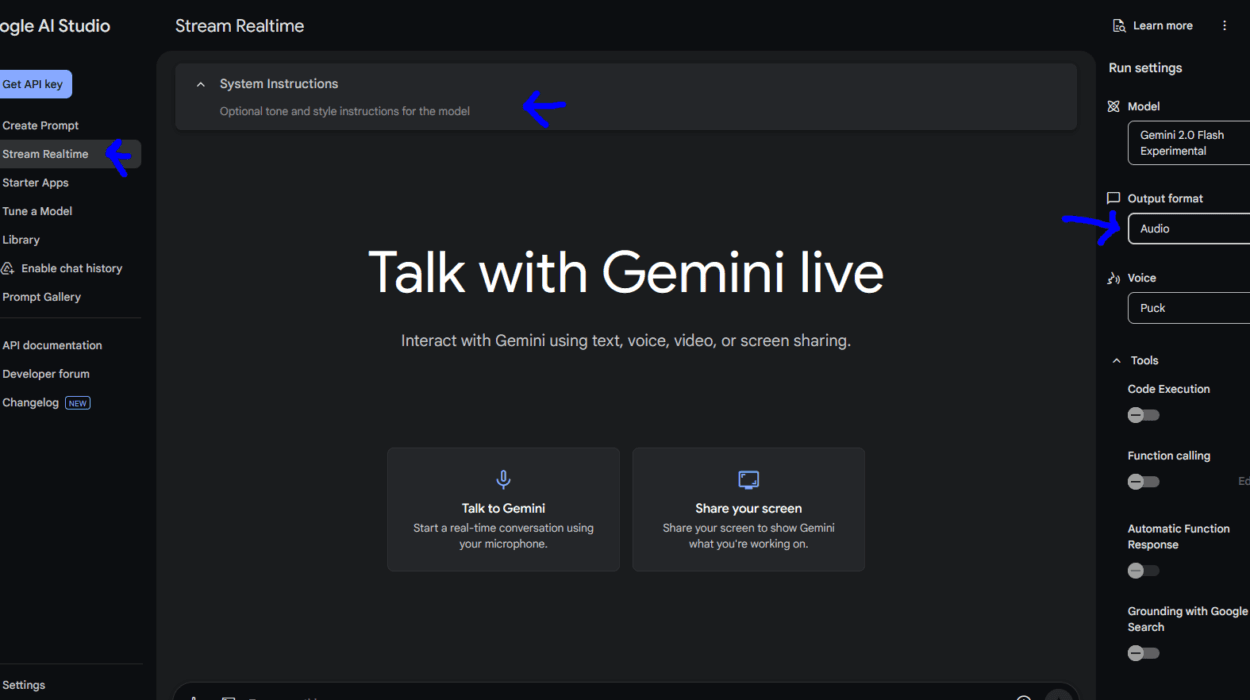

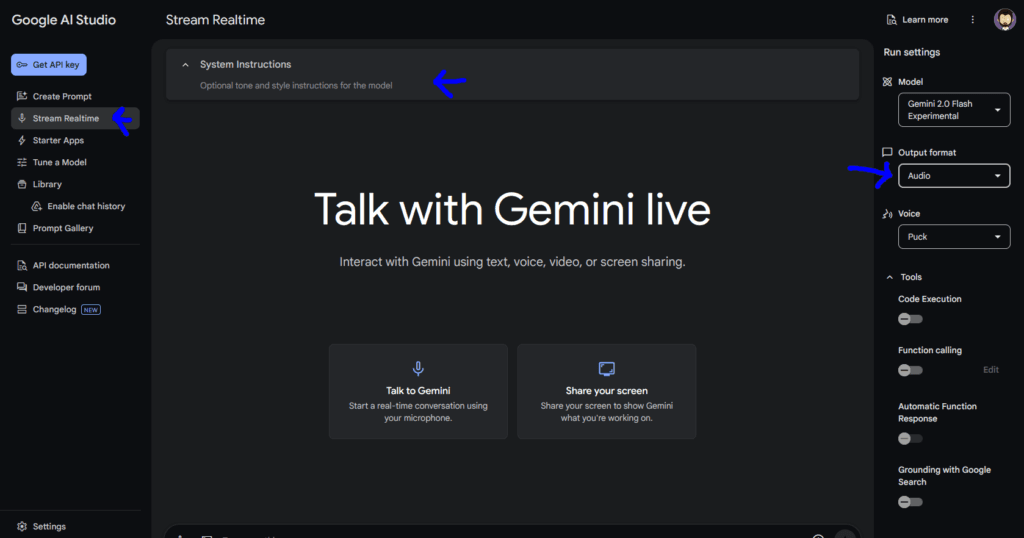

Let’s start with the star of the show: Google AI Studio. This isn’t your average chatbot—it’s a real-time tool that records your screen and microphone to assist with whatever you’re working on. In the video, the host uses its streaming feature to analyze trading charts, and it’s like having a second set of eyes that never blinks. “Hey Google, can you see that?” the host asks, and the AI responds, “Yes, I can see that—I see a chart for Tesla stock on the 240-minute time frame.” Boom, it’s game on!

So, how does it work? You fire up Google AI Studio, share your screen, and start asking questions. The AI watches your charts—whether it’s Tesla, SPY, or Bitcoin—and breaks down what it sees. It’s built to recognize patterns, suggest indicators, and even crunch numbers, all while you guide it with your voice. The video warns, though: “It records your microphone and screen, so be really careful not to share confidential info.” Google might use this data to train its models, so keep your passwords and account balances off-screen!

For traders, this is a goldmine. The AI doesn’t just parrot generic advice—it adapts to what’s on your screen. When the host showed Tesla’s chart, it spotted an upward trend since mid-October and flagged consolidation around $430. It’s not perfect, though—it struggled to navigate TradeStation’s UI, vaguely suggesting, “Look for a studies or indicators button.” Still, for general concepts like trends and resistance, it’s spot-on. Entities like Tesla and TradeStation pop up naturally here, boosting SEO while grounding the tech in real-world use.

Why should you care? Because Google AI Studio could save you hours of squinting at charts. It’s like a turbocharged assistant that catches patterns you might overlook—perfect for day traders or anyone chasing quick setups. Pair it with primary keywords like “AI trading tools” and related terms like “stock trading AI,” and you’ve got a recipe for content that ranks and resonates. Want to try it? Head to Google’s site, but don’t hand over your trading keys just yet—it’s a helper, not a replacement.

Analyzing Tesla’s Ascending Triangle

Now, let’s zoom into the juicy part: Tesla’s chart. The host pulls up a 240-minute timeframe, and the AI dives right in. “It appears Tesla stock has been trending upwards since mid-October with some volatility,” it says, noting consolidation around $430. Then comes the kicker: “There’s a potential ascending triangle pattern forming—the price has been making higher lows while struggling to break through resistance around $440.” If that breakout hits, it’s a green light for a trade!

What’s an ascending triangle? It’s a bullish pattern where the price keeps testing a resistance level (here, $440) while forming higher lows—a sign buyers are gaining steam. The AI nailed it, and the host was impressed: “Okay, so an upward trend—are you thinking something like this?” They draw a trendline, and the AI adjusts, spotting a counterpoint—a recent downward shift forming a descending triangle. “This indicates the price might consolidate and could break down if it doesn’t breach the upper line,” it warns. Actionable? You bet—watch $440 for a breakout or brace for a dip.

To juice up the analysis, the AI suggests indicators like RSI. “Based on where RSI is right now—around 50—it suggests the price isn’t overbought or oversold,” it explains. That neutral momentum backs the consolidation idea, giving you a clearer picture. For SEO, weave in “chart pattern analysis” and “Tesla stock trading” to capture searchers hunting for these insights. Entities like RSI and Tesla keep it authoritative, while the video’s real-time vibe makes it relatable.

Here’s the takeaway: AI can pinpoint setups fast. You could spend 20 minutes eyeballing Tesla’s chart, or let Google AI Studio call it in five. Test it yourself—load a chart, ask about patterns, and see what it flags. Just don’t bet the farm yet; the host notes, “I’m definitely not going to hand over my day trading to AI just yet.” It’s a pro-level spotter, but you’re the one pulling the trigger. Ready to catch your own breakout? Tesla’s waiting!

Spotting SPY’s Reversal Signals

Next up: the SPY ETF, tracking the S&P 500. The host switches charts, highlights a “big red candle,” and asks, “What would something like that indicate?” The AI doesn’t miss a beat: “That large red candle on the 240-minute chart for SPY indicates a significant price drop in a single period—this could suggest strong selling pressure and a potential reversal of the recent upward trend.” Translation? A sharp drop like that screams “pay attention!”

The host digs deeper: “If price comes back up to this area, would it be a good place to short?” The AI nods (well, metaphorically): “It could potentially act as a resistance level, making it a possible area to consider shorting—but watch for confirming signals.” They propose shorting at $6041.33 for 25 shares, asking for a cover target. “A reasonable place would be around $578, acting as support,” the AI replies, calculating a $647.75 profit before commissions. That’s real-time, actionable math!

For SEO, “SPY ETF trading” and “real-time chart analysis” fit like a glove here, while entities like SPY and Google AI Studio boost credibility. The red candle’s a classic reversal signal—price plummets, sellers dominate, and the trend might flip. The AI’s call to watch resistance on a retrace is gold for day traders. Add RSI or volume to confirm, and you’ve got a setup. The video’s host loved this: “Overall, this went better than expected—it seems to know a lot about patterns and resistance.”

Want to replicate this? Open SPY’s chart, spot a big move, and ask your AI buddy what’s up. It’s like having a coach whisper, “Short here, cover there.” But keep your wits—AI’s sharp, but it crashed later in the video when overloaded. Use it to flag reversals, then double-check with your gut. SPY’s volatility is your playground—let AI help you ride it like a pro!

Tips to Pair AI with Your Strategy

So, AI’s cool—but how do you make it work for your trading? The video’s host figured it out: “I did feel like I had to nudge it in the right direction sometimes, but it didn’t go off the rails.” That’s the trick—AI’s a tool, not a boss. Start by picking a chart (Tesla, SPY, whatever) and asking specific questions: “What patterns do you see?” or “Where’s the next breakout?” Guide it like a curious kid, and it’ll shine.

Step one: pair it with indicators. The AI suggested RSI and moving averages for Tesla—smart moves. “You might find moving averages helpful to confirm the direction of the trend,” it said. Load a 50-period MA on your chart; if it slopes up while an ascending triangle forms, that’s double bullishness. RSI at 50? It’s neutral, so watch for a shift. Keywords like “day trading patterns” and “Google AI trading” tie this to search intent, while TradeStation as an entity keeps it grounded.

Step two: test small. The host didn’t dive in blind—they asked, “What would my profit be?” and got $647.75 on SPY. Use AI to simulate trades—short SPY, go long Tesla, whatever—then paper trade it first. The video’s disclaimer rings true: “You should not take financial advice from an AI or from me.” It’s entertainment, but it’s practical too. Step three: know its limits. It crashed on a big portfolio analysis, so keep queries tight—one chart at a time.

Final tip: blend it with your gut. The AI spotted patterns “better than expected,” but the host stayed in control. Use it to brainstorm, confirm, or calculate—not to decide. Try this: analyze a chart, jot down AI’s take, then sleep on it. Next day, trade what you believe. That’s the pro move—AI as your wingman, not your pilot. Ready to tweak your strategy? Fire up Google AI Studio and see what it spots for you!

Wrapping Up

Alright, let’s wrap this up! Testing Google AI Studio on Tesla and SPY charts was a wild ride—proof that AI can spot trading patterns like a pro, even if it’s not ready to steal your job. From Tesla’s ascending triangle hinting at a $440 breakout to SPY’s red candle screaming reversal, this tool’s got serious chops. It’s fast, it’s sharp, and it crunches numbers like a champ—$647.75 profit on a SPY short? Yes, please! But it’s not perfect; it needs your nudge to stay on track and can’t handle overload. Still, for pattern-hunting and quick insights, it’s a game-changer.

The actionable wins? Use it to flag breakouts or reversals fast—Tesla’s $440 resistance and SPY’s $578 support were spot-on calls. Pair it with RSI or moving averages to confirm, and you’re cooking with gas. The host nailed it: “It seems to know a lot about patterns and trends.” But don’t ditch your instincts—AI’s a sidekick, not a substitute. Test it on your charts, guide it with clear questions, and watch it shine. Oh, and keep it simple; it crashed when pushed too hard.

For traders, this is your invite to experiment. Whether you’re chasing Tesla’s next move or shorting SPY, AI can save time and spark ideas. It’s not about handing over control—it’s about amplifying what you already do. So, grab Google AI Studio, load a chart, and see what patterns pop up. You might just find your next big trade. Want more? Share your AI trading wins below—I’d love to hear how it works for you. Now, let’s get trading smarter!

Key Takeaways

- AI excels at pattern recognition: It spotted Tesla’s ascending triangle and SPY’s reversal fast.

- Google AI Studio is real-time: It analyzes your screen live, making it perfect for quick setups.

- Tesla’s breakout potential: Resistance at $440 could signal a profitable trade entry.

- SPY’s shorting win: A $647.75 profit was calculated from a $6041.33 short to $578 cover.

- Indicators boost accuracy: RSI and moving averages refine AI’s calls.

- Guide the AI: Nudge it with specific questions to keep it on track.

- It’s not flawless: It crashed on big analyses, so keep it focused.

- Blend with instinct: Use AI as a tool, not a decision-maker.

Want to trade smarter with AI? Dive into Google AI Studio now—click here and start spotting patterns today!