To improve efficiency and provide a better, fully-permission-less user experience, Optionblitz, a decentralized trading platform, was built on an Ethereum Layer 2 scaling solution called Arbitrum. Digital options, traditional options, and our flagship trading product, Turbos, are all available to you as a trader. The first-ever decentralized Turbos, combining the best of leveraged certificates and perpetual swaps, are being brought to the blockchain by this broker.

Optionblitz additionally allows you to stake USD Coins for the purpose of liquidity mining. Staking USDC for a cut of the profits gives liquidity providers full discretion over their money and protects them from any short-term losses.

If you’re wondering about Option Blitz and how it uses blockchain technology in trading, let’s go through the ins and outs of this platform in this OptionBlitz Review.

OptionBlitz Review: Features

Platform for Social Trading and Decentralized Options

Arbitrum, the protocol used by Ethereum’s Layer 2 network, powers Option Blitz, a decentralized trading platform. Because of this, derivatives traders may rest assured that the platform is both open and accountable.

Feeding Costs

Guaranteed pricing feeds are provided via low-latency oracles on the Pyth.network platform. This guarantees that the prices used in trades are as up-to-date and accurate as possible.

Near-instant Trade Execution

With the Arbitrum Layer 2 solution, users can benefit from the decentralized nature of the platform while still enjoying near-instant trade execution.

Yields and Staking

Users of Option Blitz have the option to take part in “yield farming.” Staking USDC allows users to participate in the network’s earnings. When combined with BLX, the enhanced benefits can help you outperform the market. APY.

Expiration

OptionBlitz’s fast trading windows are one of the platform’s best features. Digital options trading gives investors the opportunity to trade with expiration times as short as 30 seconds. Quick traders who aim to profit from temporary market fluctuations may like this function.

Bonuses and Rewards

OptionBlitz appreciates its customers and provides bonuses to help them trade more profitably. The platform’s in-app faucet gives users the chance to receive free bonuses in the form of USDB. This increases the user’s trading capital and spices up the trading experience.

Support

OptionBlitz’s round-the-clock service stems from the company’s understanding of the nuances of trading and the difficulties its customers may encounter. Users may rest easy at any hour of the day or night knowing that a devoted crew is always accessible to answer their questions in one of several languages.

0 Network Fees

Trading costs can often eat into a trader’s profits. Recognizing this, Option Blitz offers a unique feature where clients can opt to have blockchain network costs included in their transactions. This ensures friction-less trading, further supported by Biconomy, allowing traders to maximize their returns without worrying about additional fees.

$1 Minimum Trade Size

OptionBlitz ensures that trading is accessible to everyone, regardless of their investment size. With a minimum trade size of just $1, both novice traders and those with limited capital can participate in the world of decentralized trading.

Non-Custodian

Protecting one’s assets and maintaining command over one’s trading capital are of utmost importance. Because Option Blitz uses a non-custodial model, users retain full access to their money at all times. Users may rest assured that their funds will never leave their control because a third party is never involved.

Leverage Of 1:100

Option Blitz provides leverage of up to 1:100, which increases trading possibilities. This means that traders can exert influence over a position that is considerably larger than their initial outlay, increasing their potential for profit. Traders should utilize leverage cautiously because, while it increases the potential for profit, it also increases the potential for loss.

Trading Instruments

Traders can choose from a wide range of financial contracts, including classic American options trading, binary options, touch options, no touch options, double touch options, and perpetual options.

Safe Trading Environment

The Arbitrum blockchain protects the platform’s desktop and mobile web trading interfaces.

Staking Rewards

Users can contribute USDC as liquidity to the platform and partake in the platform’s profits. To maximize returns, users can engage in dual staking with BLX and lock funds for a predetermined period of time.

Diverse Trading Pairs

OptionBlitz Review offers over 100 trading pairs, covering Forex, Crypto, Metals, Energy, Stocks, and Indices.

Integration Partners

Option Blitz has partnered with several entities to enhance its offerings. This includes low-latency price feed oracles provided by Pyth, gasless transactions enabled by Biconomy, network infrastructure powered by the Arbitrum blockchain, and security measures audited by Certik.

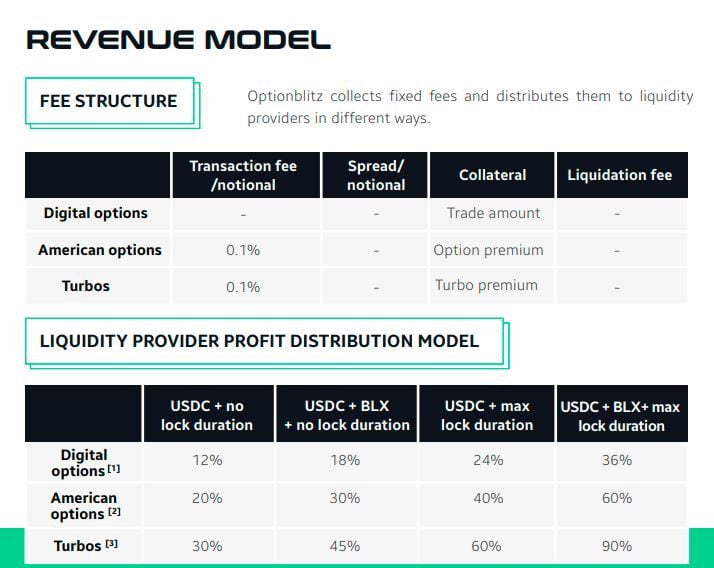

OptionBlitz Review: Fee Structure

This section outlines how OptionBlitz earns its revenue through different transactional activities.

Digital Options

- Transaction Fee/Notional: Not applicable. It seems that OptionBlitz does not charge a direct transaction fee for digital options.

- Spread/Notional: Not applicable. There isn’t a spread charge on digital options.

- Collateral: This fee is based on the trade amount. The exact percentage or value isn’t specified in the given information.

- Liquidation Fee: No liquidation fee is applied to digital options.

American Options

- Transaction Fee/Notional: For every transaction involving American options, OptionBlitz charges a fee of 0.1%.

- Spread/Notional: There is no specified spread charge for American options.

- Collateral: This fee is taken from the option premium, but the exact amount or percentage isn’t given in the provided data.

- Liquidation Fee: No liquidation fee is applied to American options.

Turbos

- Transaction Fee/Notional: Turbos have a transaction fee of 0.1%, similar to American options.

- Spread/Notional: There’s no spread fee for turbos.

- Collateral: The fee is taken from the turbo premium. The exact details are not provided.

- Liquidation Fee: No liquidation fee is charged for turbos.

Liquidity Provider Profit Distribution Model

This segment details how OptionBlitz distributes profits to its liquidity providers. The distribution varies based on the type of option and the conditions related to the USDC and BLX lock duration.

Digital Options

USDC with no lock duration: Liquidity providers receive a 12% profit.

USDC + BLX with no lock duration: The profit for liquidity providers is 18%.

USDC with maximum lock duration: Liquidity providers get 24% profit.

USDC + BLX with maximum lock duration: Profit distribution is at 36%.

American Options

USDC with no lock duration: 20% profit for liquidity providers.

USDC + BLX with no lock duration: 30% profit.

USDC with maximum lock duration: 40% profit.

USDC + BLX with maximum lock duration: A 60% profit is distributed to the liquidity providers.

Turbos

USDC with no lock duration: Liquidity providers receive 30% profit.

USDC + BLX with no lock duration: They get 45% profit.

USDC with maximum lock duration: The profit stands at 60%.

USDC + BLX with maximum lock duration: Liquidity providers enjoy a 90% profit.

OptionBlitz Review of Affiliate Program

OptionBlitz offers an affiliate program where participants can earn based on the total trading revenue generated by their own account and any referrals they make. OptionBlitz has a unique model for distributing profits to its liquidity providers. The platform collects fixed fees and then distributes them in various ways to those who provide liquidity.

Affiliate Earnings

Affiliates have the potential to earn up to 12.5% of net profit on digital options.

They can also earn up to 40% of transaction fees collected on leveraged products.

Possibilities of Revenue Sharing

Depending on the type of investment made, users of the site can participate in a variety of revenue sharing models. Summarized Here:

- Every source of liquidity must put up USDC as collateral.

- Liquidity providers have the flexibility to choose the duration for which they want to lock their funds inside the staking protocol.

- No Lock Duration option allows liquidity providers to withdraw their funds on-demand without any lock-in period.

- Maximum Lock Duration option offers a multiplier effect on returns. It is capped at a duration of 52 weeks and provides a +50% pay-out boost.

- Bonding the BLX token to your stake can further enhance returns. A maximum of +50% pay-out boost is offered for those who bond the BLX token to their stake.

Profit Distribution Details

- Digital Options: The distribution is based on net profit, which is calculated as deposits minus withdrawals.

- American Options: The distribution is based on net revenue, calculated as premiums minus payoffs.

- Turbos Profit Distribution: For turbos, liquidity providers earn a share of the net revenue. This is determined by inflows minus outflows.

Getting Started with OptionBlitz

OptionBlitz is a decentralized option and social trading platform that offers many features for novice and experienced traders in OptionBlitz Review. If you’re considering going into the world of decentralized trading with OptionBlitz, here’s a step-by-step guide to help you get started:

To begin your trading journey:

- Visit the OptionBlitz website.

- Click on the “START TRADING” button. This will guide you through the process of setting up your trading account and getting familiar with the platform’s interface.

Trading Products and Tools

OptionBlitz offers a wide range of trading products and tools. Let’s look at them next in this OptionBlitz Review.

- Price feeds are guaranteed by Pyth.network low-latency oracles.

- The platform boasts near-instant execution for traders, thanks to the Arbitrum layer 2 solution.

- If you’re interested in yield farming, Stake USDC on the platform.

- Earn a revenue share from your staking. You can even combine this with BLX to enhance your rewards.

- OptionBlitz offers various revenue share opportunities based on investment categories.

- All liquidity providers require USDC deposits. You can choose the duration to lock your funds, with options ranging from ‘no lock duration’ to a maximum of 52 weeks. Bonding the BLX token to your stake can further enhance your returns.

- For those new to trading or looking to sharpen their skills: Visit the OptionBlitz trading academy.

- Learn how to trade on the platform, study technical indicators, and develop profitable trading strategies.

Pros and Cons of OptionBlitz Review

Pros

- Operates on the Ethereum Layer 2 protocol, Arbitrum, ensuring transparency and accountability.

- Price feeds are backed by Pyth.network low-latency oracles, ensuring accurate and up-to-date price information.

- The Arbitrum Layer 2 solution offers traders almost immediate execution of their trades.

- Users can participate in yield farming by staking USDC, with the potential to supercharge rewards by combining with BLX.

- Offers a range of instruments including Binary, Touch, No-Touch, Double Touch, Double No-Touch, Classic American style options trading, and Perpetuals.

- Both desktop and mobile web trading interfaces are secured by the Arbitrum blockchain.

- Users can provide liquidity and earn a share of profits, with options to lock funds for enhanced returns.

- Offers trade windows as low as 30 seconds for digital options trading.

- Users can claim free bonuses from the in-app faucet.

- Option to include blockchain network costs in transactions, supported by Biconomy, for friction-less trading.

- Over 100 trading pairs are available, covering various markets.

Cons

- Traders new to the site may feel overwhelmed at first by its abundance of tools and capabilities.

- High leverage can increase gains, but it can also increase losses, making it riskier for traders without much expertise.

- All crypto platforms put their customers at risk by exposing them to the up-and-down nature of digital asset prices.

- While staking can increase profits, it’s not necessarily a good idea to keep money locked up for long periods of time if you require access to those assets in the future.

Alternatives of OptionBlitz Review

PsyOptions

PsyOptions is a decentralized ecosystem offering many financial services that are fast and reliable thanks to the Solana blockchain.

Cega

DeFi created Cega, focuses user security and transparency when creating yield techniques, unlike other decentralized options platforms.

Friktion

Friktion is a bitcoin management app. Its durability gives investors better portfolio control over multiple market epochs.

Jones DAO

The full-featured Jones DAO protocol offers traders yield, strategy, and liquidity options.

So, if you find this OptionBlitz Review insightful, we suggest you give it a try and see if it works for you! To get started, Click here.

OptionBlitz Review: FAQs

How Does OptionBlitz Use Blockchain?

The blockchain is a distributed database that adheres to a set of rules for transferring data, one of which is consensus. The OptionBlitz trading protocol is written in blockchain code, and the network polices itself to ensure that all trades are final and unchangeable. Since it is impossible to alter the transaction or the circumstances for the transaction to occur without the system failing to reach a consensus, this safeguards customers from fraud or manipulation.

If Registration is Not Required, How Do I Sign In?

Your app wallet, such as Metamask, or a 1-click login with social authentication, such as Google, will load as options when you click the login button. This creates a wallet in your browser where you can store coins like USDC.

How Does OptionBlitz Deposit Work?

Deposits are not required! To fund your USDC wallet, just send USDC from another address or purchase USDC using the in-app currency exchange. Over 140 countries are supported for both bank transfers and debit/credit card payments. We never have access to the secret keys that would allow us to access your funds. Therefore, your money is always safe.

Are Traders From The US Also Permitted?

Yes