Trading binary options can be an exhilarating rollercoaster ride in the financial markets. And if you’re a thrill-seeker looking for a fast-paced strategy, the Quotex 1 Minute Strategy might be right up your alley. This approach demands quick thinking and even quicker execution. So, buckle up as we guide you through the ins and outs of mastering this electrifying technique.

Sign Up for My Free Binary Options PDF: Get access to all my strategies and tools by signing up for my free binary options PDF.

Quotex 1 Minute Strategy Explained

In order to trade 1 minute binary options, you must follow a few simple steps outlined below:

Quotex Chart Setup

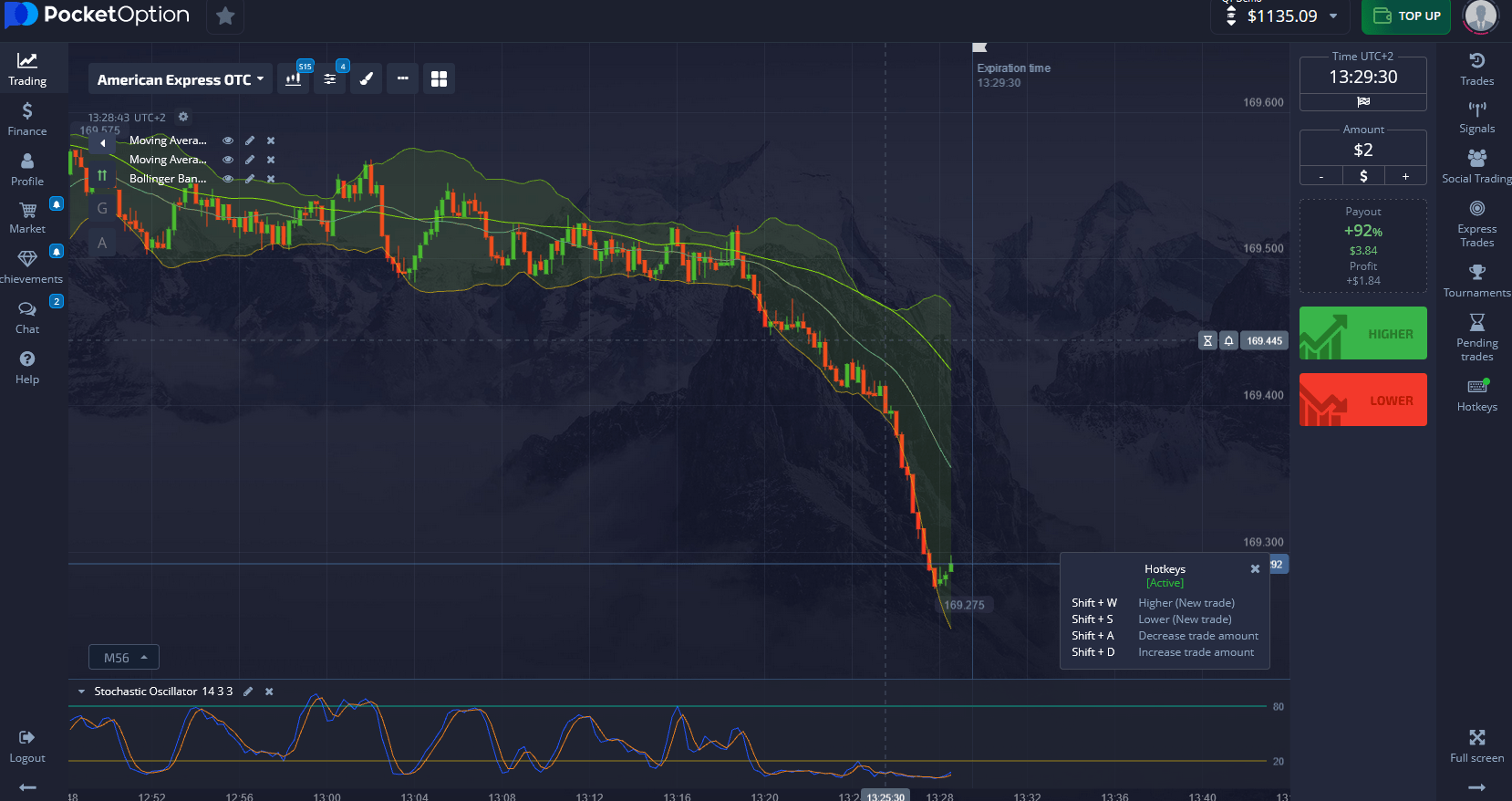

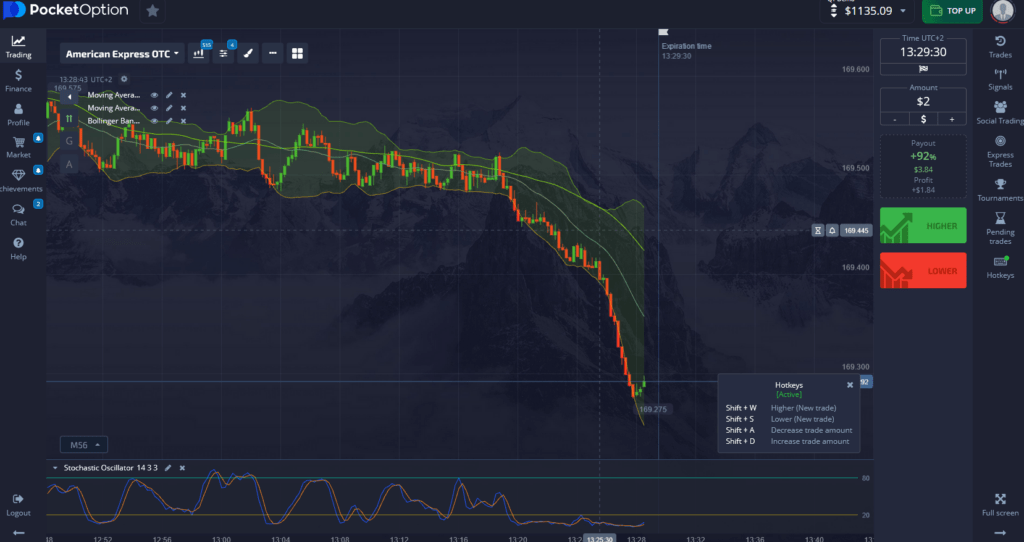

Before you dive headfirst into the action, you’ll need to set your chart up like a pro. First things first, switch to the 1-minute timeframe on your Quotex platform. This granular view lets you track price movements minute by minute, a crucial element for this rapid-fire strategy.

Next up, add a couple of exponential moving averages (EMAs) to your chart, say the 20-period and 50-period. These handy indicators will help you spot the prevailing trend, like a seasoned pro. But wait, there’s more! Slap on some Bollinger Bands, with a period of 20 and a standard deviation of 2. These bad boys will help you identify when the price is overbought or oversold, signaling a potential reversal.

And let’s not forget about those candlestick patterns. Get cozy with the likes of Hammers, Dojis, and Engulfing patterns – they’re your trusty sidekicks for spotting potential reversals.

Now, let’s imagine the EUR/USD pair is trading at 1.2000. You notice the price is riding the uptrend wave, moving above the 20-period EMA. Plus, those Bollinger Bands are expanding, hinting at increased volatility. Then, boom! A Doji candlestick forms near the upper Bollinger Band, signaling a potential reversal. Time to make your move!

Putting in a Put Option

When you’re ready to profit from a falling asset price, it’s time to whip out a put option. But how do you know when to pull the trigger? Keep your eyes peeled for these key signs:

- Overbought Conditions: If the price touches or surges past the upper Bollinger Band, it might be time for a breather. This movement often signals that the asset is overbought and due for a correction.

- Bearish Candlestick Patterns: Confirm your hunch with some bearish candlestick patterns like the Doji or Bearish Engulfing. These bad boys are like a flashing neon sign, screaming “reversal ahead!”

- Enter the Trade: Once you’ve identified the overbought condition and confirmed it with a bearish candlestick pattern, it’s showtime! Enter that put option and hold on tight.

Let’s paint a picture. Say you’re trading the GBP/USD pair, and you see the price kissing the upper Bollinger Band at 1.3500. At the same time, a menacing Bearish Engulfing pattern rears its head, signaling a potential reversal. You decide to enter a put option, anticipating that the price will take a nosedive.

Calling in a Call Option

On the flip side, when you’re looking to profit from an asset’s price surge, it’s time to dial up a call option. But how do you know when to make that call? Keep your eyes peeled for these telltale signs:

- Oversold Conditions: If the price touches or dips below the lower Bollinger Band, it might be time for a rebound. This movement typically indicates that the asset is oversold and ready to bounce back.

- Bullish Candlestick Patterns: Confirm your hunch with some bullish candlestick patterns like the Hammer or Bullish Engulfing. These bad boys are like a green light, signaling a potential reversal.

- Enter the Trade: Once you’ve identified the oversold condition and confirmed it with a bullish candlestick pattern, it’s go time! Enter that call option and get ready for liftoff.

Imagine you’re monitoring the USD/JPY pair, and the price grazes the lower Bollinger Band at 110.50. Then, like a knight in shining armor, a Hammer candlestick forms, signaling a potential reversal. You decide to enter a call option, expecting the price to soar like an eagle.

Quotex 1 Minute Live Trade (Recorded)

Watch this short video and see me trade another 1 Minute Strategy on Quotex, make sure to subscribe to my Channel and Newsletter for more strategies and information about trading:

Managing Your Money Wisely

Great power comes with great responsibility, and in the world of trading, that responsibility lies in effective money management. Here are some tips to keep your finances in check:

- Fixed Percentage: Use a fixed percentage of your trading account for each trade, typically 1-2%. This practice helps you manage risk and prevents significant losses from derailing your entire operation.

- Emotions? Leave ‘Em at the Door: Stick to your trading plan like a true professional, and avoid making decisions based on emotions. Overtrading or chasing losses can quickly turn your account into a ghost town.

- Stop-Loss and Take-Profit: Although binary options have a fixed expiry, having predefined levels for when to exit trades can help you manage risk and lock in profits like a boss.

For example, if you have a $1,000 trading account, consider risking only $10-$20 per trade. This approach ensures that even if you hit a rough patch, you can keep trading without having to take out a second mortgage.

Trading Longer Expiration Times

While the 1-minute timeframe is a fan favorite for its lightning-fast pace, you can also trade longer expiration times by simply adjusting your chart timeframe. Here’s how:

- Change the Timeframe: Switch your chart to a longer timeframe, like 5 minutes or 15 minutes. This adjustment gives you a broader view of market movements and can help you cut through the noise.

- Adjust Your Indicators: Modify your indicators to fit the new timeframe. For example, use a 20-period and 50-period EMA and adjust your Bollinger Bands to the new timeframe settings.

- Identify Entry Points: Use the same principles to identify entry points for put and call options, but apply them to the longer timeframe.

For instance, switching to a 5-minute chart, you notice the price grazing the upper Bollinger Band, and a menacing Bearish Engulfing pattern forms. You decide to enter a put option with a 5-minute expiration, anticipating a downward move.

Quotex 1 Minute Strategy – Wrapping it Up

The Quotex 1 Minute Strategy is an adrenaline-fueled approach to trading that can yield some serious thrills (and potentially some serious profits). By setting up your chart like a pro, understanding when to enter put and call options, and practicing sound money management, you’ll be well on your way to mastering this fast-paced technique. Remember, patience and discipline are the keys to unlocking long-term trading success.

Sign Up for My Free Binary Options PDF: Get access to all my strategies and tools by signing up for my free binary options PDF.

With this insider’s guide under your belt, you’re ready to tackle the Quotex 1 Minute Strategy like a seasoned pro. So, what are you waiting for? Let’s get trading!